Investing in anything in life benefits from an early start. Whether it is your energy, time, money, habits or take your pick. We all agree with the – maxim slow and steady wins the race; it also applies to investing. Start investing in your 20’s and you can open many doors.

Beginning our careers early in the mid-’20s, the salary we receive may not be high. However, there is a constant temptation to spend because we have earned it. At this stage, saving and investing for the future is the last things in our minds. Most of us are naive in thinking and understanding – we have time on our hands. Let us enjoy the moment. Let us live today, we will start saving tomorrow. When we have more that is. These are the naïve thoughts that cloud our infant minds.

To be rich and wealthy begin now or regret later. Start small.

Below are few points that tells why should make time as our friend and start investing:

Start investing in your 20’s even with a small amount as investment tenure is longer

The longer money is invested, the more potential it has to grow this strategy is followed by none other than Warren Buffett, an American investor, business tycoon, philanthropist. There is a general understanding among the experts that Investors who start early, practice patience and stick to a long-term investing strategy often see the best returns and financial success.

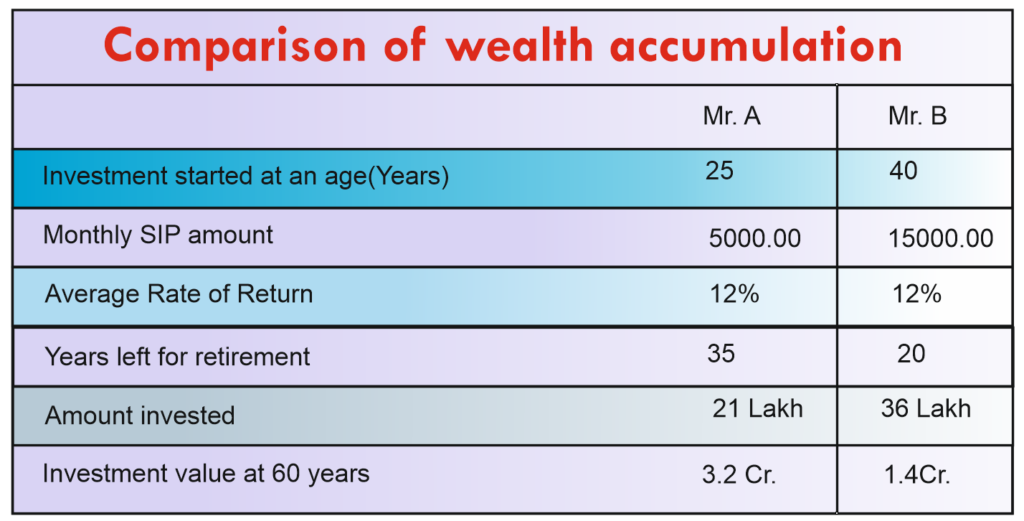

Let’s try to understand this with two examples. Let’s take an example of Mr A who is 25 years old and Mr B who is 40 years old. Both of them are thinking of investing till the age of 60. As it is clearly visible from the example below that just a difference of 15 years allowed Mr A to gain almost 2.17 times of Mr B. Despite investing more Mr B could not match up to Mr A’s final amount.

Investing in your 20’s results in improving your spending habit

The habit of investing early has multiple benefits. It keeps a check on your wasteful spending. You automatically feel the need to improve spending habits. In order to streamline investing you will be required to make a budget. It helps track your monthly expenses on food, utilities, leisurely activities, rent etc. And with years of practice, making and sticking to a budget ultimately bring huge financial gains.

Best way is to first put away the amount you want to save every month first. And then create a monthly budget with the remaining amount. For example, if you earn Rs 35,000 every month and want to save Rs 8,000. As soon as you receive your salary, first put away the Rs 8,000, then maintain your expenditure with the remaining amount.

By investing in your 20’s, enjoy the benefit of compounding with time

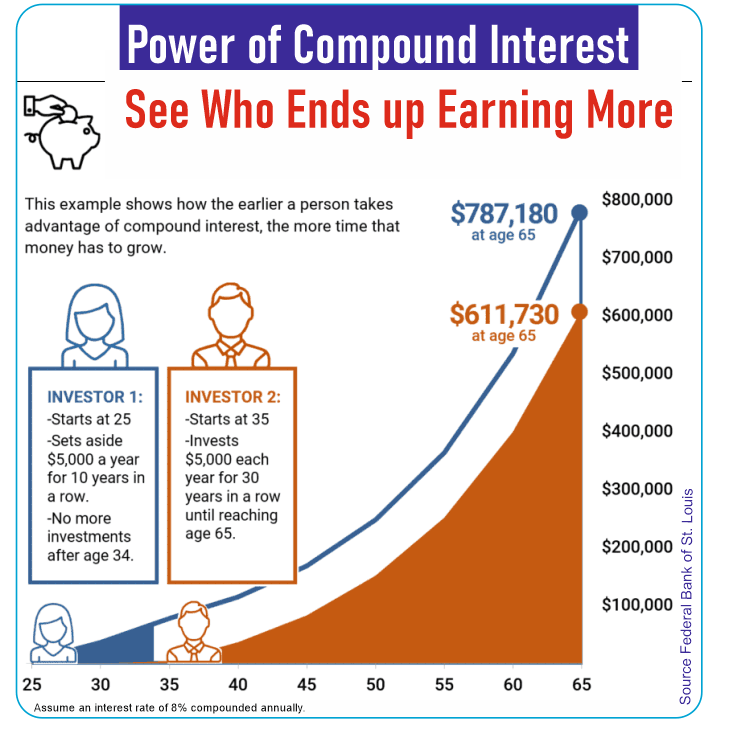

The earlier you start investing, the more you will enjoy the benefit of compounding growth as your investment tenure is longer

For example, you and your friend think of saving Rs 4 crore each for your retirement. You start investing in an equity mutual fund from the age of 25. Hence from now on, every month you would have to save Rs 6,000 till the age of 60. This will result in you investing Rs 25.2 lakh in total for 35 years till the age of 60.

But your friend took his own sweet time thereby delaying the goal by 15 years. Hence, he started saving towards retirement at the age of 40. Though the target amount remains the same, i.e Rs 4 crore. But this delay will mean that your friend’s monthly investments would be Rs 40,000. This will result in your friend investing Rs 96 lakh in total for 20 years till the age of 60.

Therefore, by delaying the investment for 15 years, your friend’s monthly investment amount increases more than six times compared to you. This would result in your friend investing around four times the money that you invested. This is how compounding works over the years.

Starting young, you amass a larger corpus for staying invested longer

Since you can have the benefit of compounding longer for staying invested longer, the corpus amass over the years will also be much higher.

To explain this, we can take the cue from the point discussed earlier. While talking about the benefits of compounding, we explained that even by investing only Rs 6,000 per month you can create a corpus of Rs 4 crore just by starting early, at 25, and staying invested for as long as 35.

But if you start investing 15 years late and decide to keep the investment amount the same amount, Rs 6,000, you would be able to save Rs 59 lakh in 20 years. In both cases, you invest till the age of 60. In order to amass a corpus of Rs 4 crore in these 20 years, you will have to keep investing Rs 40,000 till the end of the tenure.

Hence, it is best to start early and stay invested for a longer amount of time than to invest late with a much bigger monthly amount. Moreover investing a bigger amount may lead to compromising on your daily standard of life.

At a young age, you have a higher risk-taking ability as there is time to recover

As a young investor, when you take risks, you have time as a cushion for the losses which may occur. This risk-taking ability will shrink with age. In the mid-’20s, your financial responsibilities are far less compared to those in your 30s. And even if you go wrong with your investments, you have ample time to make up for the losses and recover.

Experts suggest a thumb rule for investing in equity which is 100 minus your age. That is, if you are 35, then you can invest 65% in equities and other in fixed-income investments. At 25, then as per the thumb rule, you can invest up to 75% in the equities. But if you start your investments at 40, you might not prefer to take that much of risk of investing 60% in the equities.

And even though equities are riskier than fixed income products, they have the potential to give you higher returns in the long run helping you to create a larger corpus for a smaller investment amount.

Conclusion

Starting early is most of the times is better. When you begin early, you give your money more time to grow. This allows you to take more risks. More risks result in more growth. On the other hand, those who start to invest in the later stages are often much more cautious with how and where they invest their money. Saving for retirement is not the only motivation you should have but you should make other well-planned investments so that you can have a steady stream of income throughout the life of the investment from the dividends of the stock. This again proves the point that individuals in their 20’s have definitive advantages over those who wait to begin investing.

So if you haven’t already started your investment process, start today. Begin with a small amount, keep it simple, and continue learning with the time. One should not forget that wealth creation is a long-term process and there is no shortcut to achieving it. So, stop procrastinating and start today no matter how small it might be. Earlier you start, better is your chance of building wealth in the long term. And as a young Investor, the biggest advantage that you have is – Time. So, make full use of it!